All 47 Democrats in the Senate and the two Independents who usually vote with them have called on the Trump administration to drop proposed rules changes that they argue would ease oversight of predatory payday lenders.

In a letter Wednesday, the senators, including the ranking members of the Banking, Armed Services and Veterans Affairs Committees, said that gutting provisions of the Military Lending Act of 2006 could limit reviews of a lender's qualifications and expose troops to exorbitant interest rates.

The changes would "make it easier for unscrupulous lenders to target U.S. troops and rip off military families," the lawmakers said in the letter to White House Office of Management and Budget (OMB) Director Mick Mulvaney, who also is acting director of the Consumer Financial Protection Board (CFPB).

The letter was prompted by reports from National Public Radio and The New York Times that Mulvaney is considering eliminating routine examinations by CFPB of firms for compliance with the Military Lending Act.

The senators charged that a two-page draft of the proposed changes for CFPB would "scrap the use of so-called supervisory examinations of lenders" on the basis that "pro-active oversight is not explicitly laid out" in the Military Lending Act.

The CFPB would now conduct an examination of a payday lender, bank or credit card company only if there is a complaint from a service member, the senators said.

On Twitter, the National Military Family Association urged the OMB to reconsider, saying, "Military families remain vulnerable to financial predators -- protections under Military Lending Act and [CFPB] must remain strong."

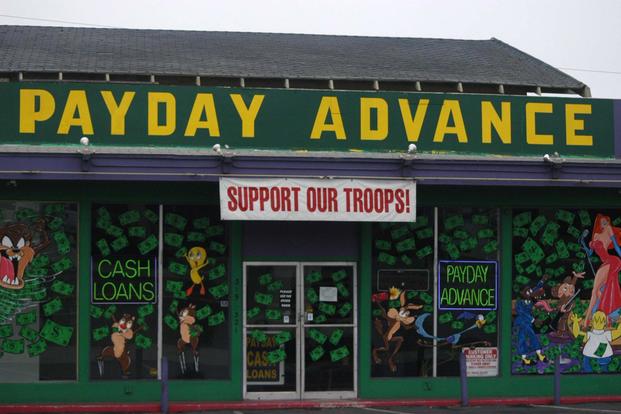

For more than a decade, military leaders, in statements and at congressional hearings, have warned troops of the dangers of being caught up in spiraling debt by resorting to payday lenders, many of whom set up storefronts just outside base main gates.

At CFPB, the Office of Service Members Affairs was formerly headed by consumer advocate Holly Petraeus, wife of retired Army Gen. David Petraeus. She made oversight of payday lenders a major concern at CFPB, but retired shortly before President Donald Trump took the oath of office.

Troops often refer to payday lenders as "snakeheads," but many are still lured in by the promise of easy terms.

At a House Appropriations subcommittee hearing in 2012, Michael Barrett, then the sergeant major of the Marine Corps, testified about what troops might have to do if a threatened government shutdown cut off their pay.

"Marines were addressing the fact that, 'Well, we can always go out in town and see the snakes,' and they were referring to the predatory loan industry, who in some instances have learned how to bypass the law," Barrett said, referring to the Military Lending Act, which capped interest rates at 36 percent for service members.

In 2013, Holly Petraeus told the Senate Commerce Committee, "Lenders have easily found ways to get outside of the definitions" of the law by adjusting the fine print of the payday loans.

"We've all seen that strip outside the base" where payday lenders congregate "like bears on a trout stream."

-- Richard Sisk can be reached at Richard.Sisk@Military.com.