As we all know from experience, the military pay system is subject to unexplained changes and mistakes. You’ve likely heard stories of service members who have received huge overpayments or didn't get paid for months. Heck, they continued paying my own husband Hawaii BAH for months after we were no longer eligible to receive it – resulting in a $10,000 "debt."

Check Your Leave and Earnings Statement

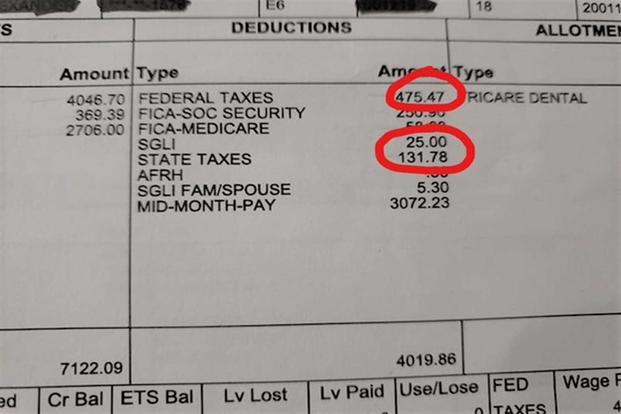

Overpayments are one of the many reasons why you need to check your Leave and Earnings Statement (LES) every month. A quick glance at your pay, allowances, deductions and allotments can identify problems the first month they happen. Caught early, you can ultimately reduce the amount of total overpayment or underpayment.

In particular, always check to make sure that your state and federal taxes are being withheld at a rate that makes sense for your situation. I’ve heard from many readers that they have had months with no taxes withheld from their military pay. While it feels great to have that extra money in your paycheck right now, incorrect withholding means you’ll owe more or receive a smaller refund later.

Related: How to Read Your LES

As long as your total tax withholding for the year is in the right range for your actual tax liability, it may not matter to you. But if taxes aren't withheld for several months, you are going to have a bill at tax time – possibly a large bill.

What to Do When Your Pay Isn't Getting Fixed

Sometimes, a service member identifies the problem and, for whatever reason, it just doesn't get fixed promptly. This can create long term problems if you are being paid too much and that money gets spent.

The simple solution? Don't spend it.

Set up a separate savings account for the amount that you know that you are being overpaid (like our Hawaii BAH). If you aren't having taxes withheld, look at the last LES where taxes were withheld properly and use that figure. Every paycheck, transfer half that amount to your special overpayment savings account. Doing so means you'll be prepared when you need that money. It might happen when the paperwork catches up and DFAS starts withholding some or all of your regular pay, or it may happen when you file your income tax returns and owe a chunk to the federal, state government or both.

What Else Should You Check On Your LES?

In addition to tax withholdings, you should take five minutes each month to download your LES and verify the following information:

- Correct pay and allowances

- BAH is based on the right zip code

- TSP contributions are being withheld as you've instructed

- Leave has been charge correctly

- SGLI/FSGLI coverage is correct

- Any debts that have shown up or are being paid

- Allotments are accurate

- The correct state for income taxes

Checking your LES when it is issued each month takes only a few minutes. Finding mistakes the first month can help get them fixed more quickly, or help you know to hold overpayments aside for when you'll need that money.

Keep Up With Military Pay Updates

Military pay benefits are constantly changing. Make sure you're up-to-date with everything you've earned. Subscribe to Military.com to receive updates on all of your military pay and benefits, delivered directly to your inbox.