Hundreds, perhaps thousands, of student veterans, despite having robust GI Bill education benefits, contend they were deceived into racking up federal loan debt through abusive practices of certain for-profit colleges.

On Tuesday these students, along with thousands of non-veterans, gained an easier path to loan forgiveness from a federal court ruling in Washington D.C.

U.S. District Judge Randolph D. Moss dismissed legal arguments from an association of for-profit colleges, which succeeded for more than a year to block Obama administration rules to bring financial relief to defrauded student borrowers and to strengthen federal protections against deceptive school practices.

The Trump administration’s Department of Education also had fought the Obama reforms until a month ago when the same judge rejected legal arguments from Education Secretary Betsy DeVos and Trump administration attorneys.

In that case, two student-borrowers and a coalition of 19 states and the District of Columbia filed separate lawsuits to invalidate the department’s stay order on Obama loan rules, which had been set to take effect in July 2017. Judge Moss called the Trump team’s effort to protect for-profit schools, and to avoid billions of dollars in loan forgiveness for borrowers, “arbitrary and capricious.”

Together the dual rulings force DeVos, who is still critical of the Obama rules are too expansive, to implement them even as her department prepares more stringent regulations. Given the statutory schedule for rulemaking, the DeVos rules can’t take effect before July 2020, the department confirmed. That creates a window for borrowers with loan debt tied to fraudulent or deceptive schools to apply for relief under more liberal rules in effect from the Oct. 16 court decision.

The department likely must update information on filing borrower defense claims. Here’s a link to what’s available now: https://studentaid.ed.gov/sa/repay-loans/forgiveness-cancellation/borrower-defense

Obama’s Education Department designed its rules to better protect student borrowers against misleading and predatory practices by postsecondary institutions; to clarify a process for federal loan forgiveness in cases of institutional misconduct; to allow group actions to replace thousands of individual loan forgiveness claims, and to hold for-profit colleges accountable for harmful practices.

The department decided its 20-year-old regulation on so-called “borrower defense claims” needed updating after a deluge of claims from students with federal loans following closure of a mega for-profit enterprise, Corinthian Colleges, in April 2015. The 1995 regulation, officials found, lacked detail on how students should submit and how the department should adjudicate a tsunami of loan relief requests. The old rule also limited eligibility for loan forgiveness to borrowers in default.

Obama officials released their final regulations in November 2016. They were to take effect the following July but the California Association of Postsecondary Schools filed a lawsuit to block them. A supportive DeVos quickly announced that she would block the Obama rules and prepare new ones to reflect concerns of for-profit schools and to protect taxpayers from automatic forgiveness of billions of dollars in federal student loans associated with failed for-profit colleges.

Consumer advocacy groups for students, including veterans, praised Judge Moss’s recent rulings.

“It’s really positive news,” said Walter Ochinko,research director for Veterans Education Success (VES), an advocacy group formed to protect veterans and their education benefits from fraud and deceptive practices.

The Obama rule went into effect at noon Oct. 16 and is to be implemented immediately. “But the devil is in the details,” Ochinko said. The judge didn’t give the department detailed instructions on how to implement the many provisions.

“It’s so easy for an administration that doesn’t want to implement something not to do it,” said Ochinko. “We’ll just have to see how it plays out…Advocacy groups will be watching very closely.”

He contends the processing of borrower defense claims by the department at “grounded to a halt” during the first half of Trump administration, a slowdown that can’t entirely be blamed on having old rules in place. But Tuesday’s court ruling creates “a window of opportunity that’s going to last until July 2020 to apply for loan forgiveness under terms much more favorable to the student than if the [DeVos alternative] had gone into effect.”

The Department of Education has been criticized in the past for not doing enough to inform students about borrower defense claims. The number of student veterans who might be eligible isn’t known, Ochinko said. The VES data base holds 4,000 complaints of deceptive practices by for-profits schools.

“Certainly, many of those veterans will be eligible,” he said. “How many have applied [already] I don’t know.”

As part of the Forever GI Bill law enacted in August 2017, veterans who used Post-9/11 GI Bill benefits at for-profit schools that suddenly closed, leaving them with worthless credits or degrees, have seen those education benefits restored.

The new Education Department rules provide additional protections. One key feature of the Obama rules will allow certain borrower defense applicants not only to have loan balances forgiven but be reimbursed for loan amounts already paid. That might be relevant for someone like former Marine Sergeant Jonathan Ngowaki

He enrolled in DeVry University in 2010 seeking a business degree. Ngowaki said he assumed his Post-9/11 GI Bill benefit would cover all costs so he resisted a push from DeVry’s financial aid office to complete a financial aid application. Finally, he relented when told it was a requirement for enrollment.

Soon, he received a $5,000 check, which a woman in DeVry’s financial aid office said was grant money. “I kept telling her ‘I don’t need the money,” he said.

By his third semester he got a lender notice, and realized he was $15,000 in debt with direct federal student loans. The money made life easier but he didn’t need it for education costs, Ngowaki said, and ordered the loan arrangement stopped.

Ngowaki’s theory is that DeVry wasn’t confident, as the Post-9/11 GI Bill began, whether student payments would arrive on schedule. Perhaps to ensure steady cash flow it pushed student veterans into federal loans. DeVry in time helped Ngowaki with some debt, he said, but most of the $15,000 he repaid himself.

Whether and how the new regulations might deliver more loan relief to a veteran like Ngowaki is still unclear, Ochinko said.

Many student veterans end up needing loans because they haven’t served long enough on active duty to qualify for full Post-9/11 GI Bill benefits. The loans become bad investments if for-profit schools close or don’t provide promised degrees or transferable credits or if employers don’t view the degrees as desirable.

One attorney for student plaintiffs who helped unleash the Obama rules, Adam R. Pulver, said an Obama change resisted by for-profit schools bans them from requiring students to accept arbitration in settling all complaints.

“It’s been pretty much exclusive to for-profit schools that to enroll you have to sign an agreement to arbitrate all disputes,” and the agreements often state that students “can’t file a class action lawsuit,” said Ochinko. “The problems of for-profit schools would have come to light a lot sooner had people been able to sue.”

Another key feature of the Obama rules would require for-profit schools facing financial risk to show a letter of credit and to make cash deposits with the Education Department as they set off various financial responsibility alarms, so taxpayers are not as deeply exposed by loan claims when for-profit schools fail.

To comment, write Military Update, P.O. Box 231111, Centreville, VA, 20120 or email milupdate@aol.com or twitter: @Military_Update.

|

Tom Philpott has been breaking news for and about military people since 1977. After service in the Coast Guard, and 17 years as a reporter and senior editor with Army Times Publishing Company, Tom launched "Military Update," his syndicated weekly news column, in 1994. "Military Update" features timely news and analysis on issues affecting active duty members, reservists, retirees and their families. Tom's freelance articles have appeared in numerous magazines including The New Yorker, Reader's Digest and Washingtonian. |

|

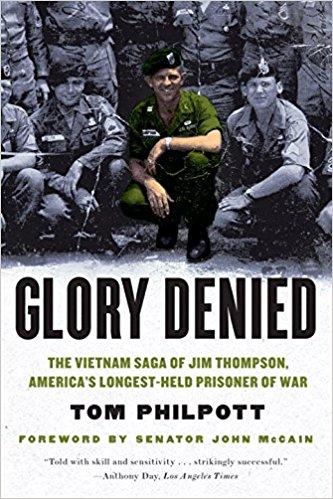

His critically-acclaimed book, Glory Denied, on the extraordinary ordeal and heroism of Col. Floyd "Jim" Thompson, the longest-held prisoner of war in American history, is available in hardcover and paperback on Amazon. |