What do potential changes to the standard deduction and mortgage interest deduction mean for Veterans?

Republicans in the House have proposed a new tax bill that contains modifications to the current tax code. The bill, known as the Tax and Jobs Act, was introduced by House Speaker Paul Ryan (R-WI) and Ways and Means Committee Chairman Kevin Brady (R-TX), among other members of House leadership and Ways and Means Committee.

Proponents of the bill aim to simplify the tax filing process and make liabilities more flat and fair, especially for middle-income Americans. Opponents are skeptical of those claims. The bill includes provisions such as significantly higher standard deductions, simplified tax brackets, increased child tax credits, a new family tax credit, and reduced tax rates for business owners, to name a few. If passed, the bill would be the first major overhaul of America’s tax code in 31 years.

Both sides of the aisle have hired economists to crunch the numbers, and both have come up with differing opinions about whether the changes would hurt or help taxpayers. But looking at the language of the bill itself with your own eyes may be a better way to get a true understanding of how the proposed changes would actually affect you. Want it straight from the horse’s mouth? Click Here to read the summary of the actual H.R. 1, Tax and Jobs Act bill.

So what does the proposed new tax law say about itemizing deductions and writing off mortgage interest?

"Tax and Jobs Act" May Reduce the Need to Itemize Your Deductions

According to the IRS, about 30% of tax filers choose to itemize. If you’re like many taxpayers, you rely on itemizing your deductions under the current tax code. For some, new higher standard deductions would be enough to skip itemizing altogether. Taking write-offs such as mortgage interest, hospital expenses, and charitable contributions may not be necessary.

That’s because, under the proposed new law, the standard deduction will nearly double across the board. If you’re married, filing jointly, your standard deduction would go from $12,700 to $24,000 for 2017. And the bill takes inflation into consideration by indexing the deduction annually. So, for example, the standard deduction for 2018 would increase to $24,400.

Raising the standard deduction may simplify the filing process for many taxpayers because it would eliminate the need to itemize. Instead, they would be able to take the standard deduction and file on a form the size of a postcard. Some would still benefit from itemizing their deductions.

Mortgage Interest Deduction Limited to First $500K of Loan

As of Q3 2017 U.S. Census data, 63.9% of Americans own their homes, and about 65% of American homeowners have mortgages. Some of those homeowners write off their mortgage interest. By IRS statistics, 22% of American taxpayers take the Mortgage Interest Deduction (MID). The new tax bill proposes keeping the MID as a line item on Schedule A, but with a significant change in the loan cap.

The current tax code allows Americans to deduct the interest paid on the first $1,000,000 of their mortgage debt.

Impact of Grandfathered Loans for Military Families

Under the proposed tax law, the debt amount eligible for the MID is reduced to the first $500,000, but only for loans taken out after the law goes into effect. The existing cap of $1,000,000 would still apply to grandfathered mortgages.

However, due to frequent moves and changing orders, many military families don’t have the option of holding on to a grandfathered loan. In fact, the Department of Defense Education Activity (DoDEA) -- the civilian agency of the DoD that manages all schools for military children and teenagers in the United States and overseas -- states that the average military family will move six to nine times, or about every two years, over a course of a child’s K-12 education.

Which means that military families could, at least theoretically, buy a new home with the VA home loan entitlement every two years, as compared to the national average of three homes over the course of a lifetime (or one every 26 years). But in doing so, the MID would reset, and the $500,000 cap would apply.

How Many People Buy $500,000 Homes?

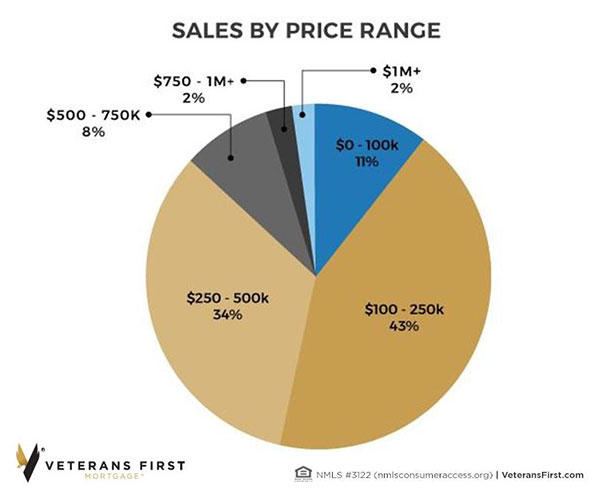

According the National Association of Realtors (NAR), the median sales price for a home amongst all Americans in September, 2017, was $245,100. This pie chart from NAR’s data shows the percentage of Americans buying homes in each price range:

By NAR numbers, 77% of people are buying homes priced at $500,000 or less.

Specific to Veterans, the 2016 VA Annual Benefits Report shows the average VA loan amount was $253,000. The 2017 VA loan limit for most counties, which limits the amount the VA guarantees on a VA loan, is $424,100. But some higher-cost counties have limits that exceed $500,000.

If these new tax rules are passed, and you’re among those who buy a home priced at more than a half a million dollars, and you get a loan on or after the effective date of the new tax law, you may not be able to write off all your interest. However, with nearly double the standard deduction and other provisions, the overall impact of the bill would come down to the individual characteristics of your household’s finances.

Ready to Get Started?

If you're ready to get started, or just want to get more information on the process, the first step is to get multiple rate quotes with no obligation. You can then discuss qualifications, debt to income ratios, and any other concerns you have about the process with the lenders.